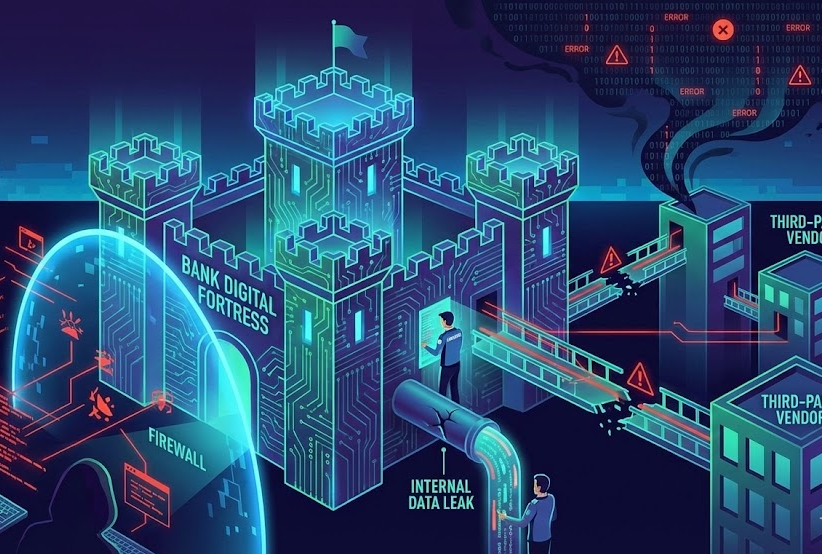

The Rising Threat Landscape in Banking

Financial institutions are frequent targets for cyber attacks due to the sensitive data they manage. As technology advances, so do the methods used by cybercriminals. Banks and other financial organizations must stay ahead of attackers who use increasingly sophisticated techniques to breach security systems and steal information.

Cyber threats in banking are not limited to just external hackers. Insider threats, whether intentional or accidental, also pose significant risks. Employees with access to critical systems can inadvertently or deliberately expose data, making it essential for institutions to have strong internal controls. Furthermore, the increasing reliance on third-party vendors and digital services expands the attack surface, giving cybercriminals more opportunities to exploit vulnerabilities.

The financial sector’s interconnectedness means that a breach in one institution can have ripple effects across the broader economy. This makes it vital for banks to continuously evolve their cybersecurity strategies and adopt a proactive rather than reactive approach.

Protecting Transactional Data in a Digital Age

To defend against these threats, financial institutions implement robust security measures. They utilise advanced encryption, regularly update their systems, and employ strong access controls to safeguard customer information. For a deeper look at these strategies, see cybersecurity in banking safeguarding transactional data. Institutions also train staff to recognize phishing attempts and suspicious activity, which helps limit the risk of insider threats and social engineering attacks.

In addition to internal controls, banks are investing in multi-factor authentication to reduce unauthorized access. This includes requiring customers and employees to provide a second form of identification, such as a code sent to a mobile device. Network segmentation is another common tactic, isolating sensitive data from less secure parts of the system. According to the Cybersecurity & Infrastructure Security Agency, these layered defenses help reduce the likelihood and impact of successful breaches.

Regulatory Compliance and Security Standards

Banks must adhere to strict regulations to safeguard customer data. Compliance with standards such as the Gramm-Leach-Bliley Act and PCI DSS is mandatory. These rules require regular audits, risk assessments, and reporting. Adhering to these standards helps financial organizations maintain a strong security posture and avoid penalties. For more on regulatory requirements, visit the U.S. Department of the Treasury’s guidance.

Beyond national regulations, financial institutions operating internationally must comply with global standards like the General Data Protection Regulation (GDPR) in Europe. These frameworks set strict guidelines for data privacy and breach notification, compelling banks to adopt rigorous data protection measures. Non-compliance can lead to hefty fines and reputational damage, making regulatory adherence a top priority for leadership teams.

The Role of Advanced Technologies

Artificial intelligence (AI) and machine learning are increasingly important in detecting and responding to cyber threats. These technologies can analyze large volumes of data in real time to identify unusual patterns or suspicious transactions. By automating threat detection, financial institutions can respond to incidents faster and reduce the chance of successful attacks. According to the Federal Reserve, adopting new technologies is essential for strengthening financial sector security.

AI-powered systems can flag anomalies that might escape traditional security tools, such as subtle changes in transaction behavior or access patterns. Machine learning models improve over time, learning from past incidents and continuously adapting to new attack methods. As cybercriminals deploy more sophisticated tools, the financial sector must keep pace by investing in smart, adaptive defenses.

Collaboration and Information Sharing

Financial institutions work together to fight cybercrime by sharing threat intelligence. Industry groups and government agencies provide platforms for banks to exchange information about emerging threats and attack methods. This cooperation helps organizations stay informed and ready to defend against new risks. The Financial Services Information Sharing and Analysis Center (FS-ISAC) is one example of such collaboration. More details can be found at.

Participation in information-sharing networks enables banks to react quickly to new vulnerabilities and attack campaigns. By pooling resources and knowledge, the industry can develop more effective strategies to thwart cybercriminals. Government agencies also support these efforts by issuing timely alerts and guidance, helping institutions stay a step ahead.

Continuous Monitoring and Incident Response

Continuous monitoring of networks and systems is critical for early detection of cyber attacks. Financial organizations deploy security operations centers (SOCs) that operate around the clock. These teams monitor for unusual activity, respond to incidents, and coordinate recovery efforts. Having a clear incident response plan ensures quick action to minimize damage if a breach occurs.

Incident response teams regularly conduct simulations to test their readiness. These exercises enable staff to practice procedures, identify areas for improvement, and refine their response strategies. According to the National Institute of Standards and Technology, effective incident response is a key component of cybersecurity resilience.

Employee Training and Awareness

Human error remains a significant risk in cybersecurity. Financial institutions invest in regular training programs to educate employees about the latest threats and best practices. Simulated phishing campaigns and security workshops help staff stay alert and cautious when handling sensitive information.

Ongoing education ensures that employees understand their role in protecting organizational assets. Training is often tailored to specific job functions, ensuring that everyone from IT staff to customer service representatives knows how to identify and report suspicious activity. The importance of a security-first culture cannot be overstated, as even the best technological defenses can be undermined by careless actions.

The Importance of Customer Education

Customers are often the first line of defense against fraud. Financial institutions provide educational resources to help clients recognize scams and protect their accounts. Tips on creating strong passwords, identifying phishing emails, and using secure banking channels are commonly shared through online platforms and customer service teams.

Many banks offer interactive tools, webinars, and newsletters to keep customers informed about emerging threats. Encouraging the use of account alerts and two-factor authentication helps customers detect unauthorized activity quickly. According to the Federal Trade Commission, informed customers are less likely to fall victim to scams.

Conclusion

The fight against evolving cyberattacks is ongoing for financial institutions. By combining advanced technology, strict compliance, staff training, and customer education, banks can better protect sensitive data. Continuous monitoring and industry collaboration further strengthen their defenses, ensuring that customer trust and security remain priorities in a digital world.

As cyber threats continue to evolve, so too must the strategies used to defend against them. Financial institutions are investing in new technologies, sharing information, and prioritizing both employee and customer awareness. This holistic approach is essential for maintaining security and public confidence in the financial sector.

FAQ

What are the most common cyber threats to banks?

Phishing, ransomware, malware, and insider threats are among the most common cyber risks faced by banks today.

How do financial institutions detect cyber attacks?

They use advanced monitoring tools, artificial intelligence, and regular security audits to detect suspicious activities and respond quickly.

Why is compliance important in banking cybersecurity?

Compliance ensures that financial institutions follow legal standards and best practices, helping to protect customer data and avoid penalties.

For More Update and Stories Visit: Info Records